Tax Spreadsheet Template Excel

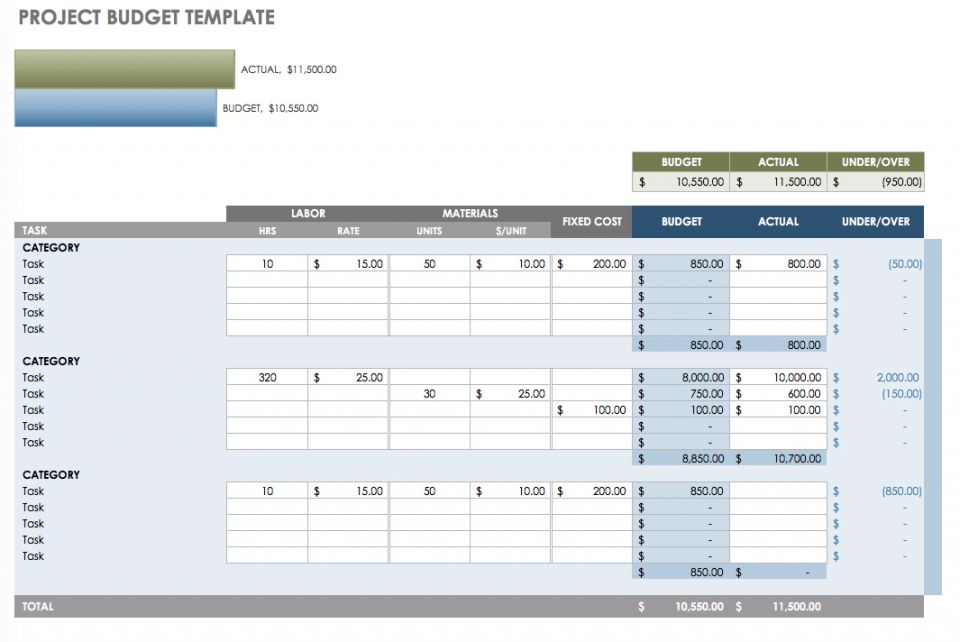

About the Worksheets These free business tax planning worksheets are easy to use. The word processing format allows you to edit text quickly and the Excel spreadsheet inserts allow you to effortlessly calculate your income and expenses. There’s even extra space in the spreadsheets to add special expenses you might have. To use the Excel inserts, double click on the calculated tables. This opens the Excel program so you can add your figures.

Here's a list of downloads related to the Tool for Business. This Excel document is only a sample of the income tax calculation template. We've created this sample to enable customers to view the layout and features of this template. You will therefore not be able to use this version of the template - the full version of the template can only be downloaded after buying the template or a.

Formulas for determining required calculations have already been entered and templates are available for the following. Just click on the link and you'll be taken to the download page for the template.

General Business Tax Information All businesses must report income activity from operations on an annual basis. Download Economics Cxc Past Papers here. The most integral part of any business tax return is the bottom line, or net income. Net income is determined by first calculating your business gross income (income from all sources), then deducting your eligible expenses.

The result is your business net income or loss. Certain other factors may impact your company’s bottom line, such as acquiring or disposing of company assets, making charitable contributions, or receiving dividends from company owned stock. Cost of Goods Sold (COGS) In general, if your business produces or manufactures items, or maintains any type of inventory, you must or sell your items separately from normal operating expenses. For example, labor costs for employees who work on an assembly line are directly associated to the cost of producing a product, whereas a regular office employee is not directly associated with producing the product. Each of the free business tax planning worksheets associated with this article includes Excel spreadsheets for calculating your COGS amount. COGS amounts reduce your company’s gross income. Auto Expenses You can take a deduction for business related auto expenses that your company incurs during the year.

The two methods for calculating vehicle expenses are the Standard Mileage Rate method and the Actual Cost method. You can only use one of the methods to figure your vehicle expense deduction, and once you choose the Standard Mileage Rate method, you must continue to use the method for the life of your business vehicle. Each year, the IRS sets a new mileage rate for business vehicle use.

You must calculate your total business miles and multiply the amount by the mileage rate. You can’t take a deduction for any other vehicle expenses when this method is used. Adobe Pro 10 Serial Number. The Actual Cost method allows you to deduct all actual costs associated with operating a vehicle, including gas, insurance, oil changes and repairs.

If you purchased the vehicle, you can take a depreciation deduction, and if you lease the vehicle you can take a deduction for the business portion of lease payments. The free business tax planning worksheets include Excel spreadsheets specifically designed for auto expense and mileage calculations. C-Corporations If you own a C-Corporation, you must report your business income and expense activity on IRS Form 1120. If you have a calendar year reporting period, your corporate tax return is due on March 15. If you have a fiscal year reporting period, your corporate tax return is due on the 15 th day of the 3 rd month following the close of your tax year. Corporations pay corporate income tax on net profits and shareholders also pay capital gains tax on dividends received from the corporation. Use the C-Corporation free business tax planning worksheet to organize shareholder information.